New Mexico Doc Financial Report Fy2009 Partb

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

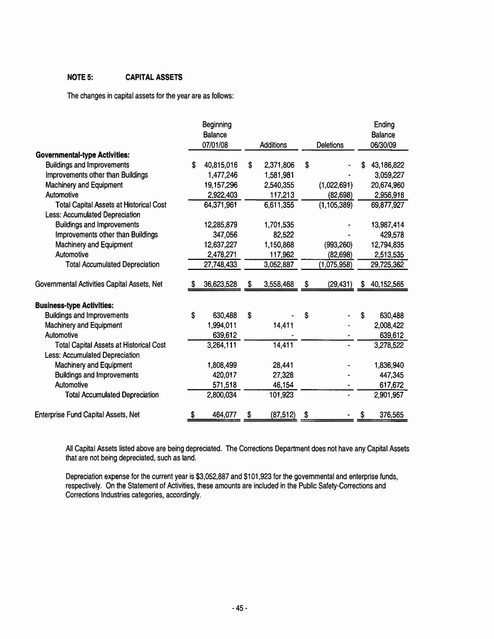

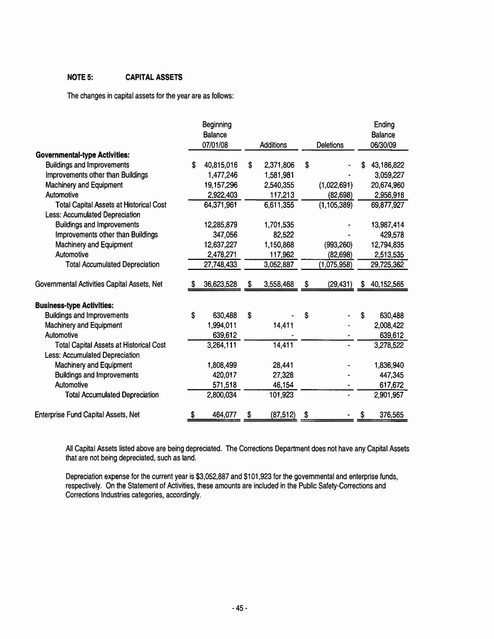

NOTES:

CAPITAL ASSETS

The changes in cap~al assets for the year are as follows:

Beginning

Balance

07/01/08

Governmental-type Activities:

Buildings and Improvements

Improvements other than Buildings

Machinery and Equipment

Automotive

Total Capital Assets at Historical Cost

Less: Accumulated Depreciation

Buildings and Improvements

Improvements other than Buildings

Machinery and Equipment

Automotive

Total Accumulated Depreciation

Govemmental Activ~ies

Cap~1

Assets, Net

Business-type Activities:

BUildings and Improvements

Machinery and Equipment

Automotive

Total Cap~al Assets at Historical Cost

Less: Accumulated Depreciation

Machinery and Equipment

Buildings and Improvements

Automotive

Total Accumulated Depreciation

Enterprise Fund Cap~al Assets, Net

Ending

Balance

Additions

$ 40,815,016

1,477,246

19,157,296

2,922,403

64,371,961

$

12,285,879

347,056

12,637,227

2,478,271

27,748,433

$

630,488

1,994,011

639,612

3,264,111

$

464,077

3,558,468

$

06130/09

$ 43,186,822

3,059,227

(1,022,691 )

20,674,960

(82,698)

2,956,918

(1,105,389)

69,877,927

(993,260)

(82,698)

(1,075,958)

13,987,414

429,578

12,794,835

2,513,535

29,725,362

(29,431)

$ 40,152,565

14,411

630,488

2,008,422

639,612

3,278,522

28,441

27,328

46,154

101,923

1,836,940

447,345

617,672

2,901,957

$

$

14,411

1,808,499

420,017

571,518

2,800,034

$

$

1,701,535

82,522

1,150,868

117,962

3,052,887

$ 36,623,528

$

2,371,806

1,581,981

2,540,355

117,213

6,611,355

Deletions

$

(87,512)

$

$

376,565

All Cap~al Assets listed above are being depreciated. The Corrections Department does not have any Cap~1 Assets

that are not being depreciated, such as land.

Depreciation expense for the current year is $3,052,887 and $101,923 for the govemmental and enterprise funds,

respectively. On the Statement of Activ~ies, these amounts are included in the Public Safety-Corrections and

Corrections Industries categories, accordingly.

·45·

NOTE 6:

RETIREMENT PLANS (STATE PERA &ERA)

PERA Plan Description

Substantially all of the Corrections Department's full time employees participate in a public employee retirement

system authorized under the Public Employees' Retirement Act (Chapter 10, Article 11 NMSA 1978). The Public

Employees Retirement Association (PERA) is the administrator of the plan, which is a cost-sharing multiple-employer

defined benefit retirement plan. The plan provides for retirement, disability benefits, survivor benetns and cost-of-living

adjustments to plan members and beneficiaries. PERA issues a separate, publicly available financial report that

includes financial statements and required supplementary information for the plan. A copy of that report may be

obtained by writing to PERA, P.O. Box 2123, Santa Fe, New Mexico, 87504-2123. The report is also available on

PERA's website at www.pera.state.nm.us.

Funding Policy

PERA plan members are required to contribute 7.42% of their gross salary for non-custody employees and 4.78% of

their gross salary for custody employees. The Corrections Department is required to contribute 16.59% of the gross

salary for non-custody employees and 25.72% of the gross salary for custody employees. From the 2009 Legislative

Session House Bill 854 temporarily shifts the burden of 1.5% of employer PERA contributions to state employees

whose annual salaries exceed $20,000. For the two-year period from July 1, 2009 to June 30, 2011, the employer

contribution rates will be reduced by 1.5% and the employee contribution rates will be increased by 1.5%. After this

temporary shift the burden will retum to the employer. The contribution requirements of plan members and the

Corrections Department is established in State statue under Chapter 10, Article 11 NMSA 1978. The requirements may

be amended by acts of the legislature. The Corrections Department contributions to PERA for the years ending June

30,2009,2008, and 2007, were $12,939,037, $8,353,900, and $13,811,420 respectively, which equal the amount of

the required contributions for each year.

ERA Plan Description

Some of the Corrections Department full-time employees participate in a public employee retirement system authorized

under the Educational Retirement Act (Chapter 22, Article 11 NMSA 1978). The Educational Retirement Board (ERB)

is the administrator of the plan, which is a cost-sharing multiple-employer defined benefit retirement plan. The plan

provides for retirement, disability benefits and cost-of-living adjustments to plan members and beneficiaries. ERB

issues a separate, publicly available financial report that includes financial statements and required supplementary

information. A copy of that report may be obtained by writing to ERB, P.O. Box 26129, Santa Fe, New Mexico, 87502.

The report is also available on ERB's website at www.nmerb.org.

ERA Funding Policy

ERA plan members are required to contribute 7.42% of their gross salary. The Corrections Department is required to

contribute 10.9% of the gross covered salary. The contribution requirements of plan members and the Corrections

Department are established in Chapter 22, Article 11 NMSA 1978. The requirements may be amended by acts of the

legislature. The Corrections Department's contributions to ERB for the years ending June 30,2009,2008, and 2007,

were $339,197, $829,632, and $442,071, respectively, equal to the amount of the required contributions for each year.

Beginning July 1, 2005, the employee contributions will increase annually until July 1, 2008 when the employee

contributions will cap at 7.9% of the employee's salary. Also, beginning July 1, 2005 the employer contributions will

increase annually by 0.75% until JUly 1, 2011 when the employer contributions will cap at 13.9% of the employee's

salary.

NOTE 7:

REnREE HEALTH CARE

The State of New Mexico is an employer who participates in a cost sharing multiple-employer plan for postemployment benefits other than pensions (OPEB). The New Mexico Retiree Health Care Authority (NMRHCA) is the

administrator of the plan.

- 46·

RHC Plan Description

The Corrections Department contributes to the New Mexico Retiree Health Care Fund, a cost-sharing multipleemployer defined benem postemployment healthcare plan administered by the New Mexico Retiree Health Care

Authority (RHCA). The RHCA provides health care insurance and prescription drug benefits to retired employees of

participating New Mexico government agencies, their spouses, dependents, and surviving spouses and dependents.

The RHCA Board was established by the Retiree Health Care Act (Chapter 10, Article 7C, NMSA 1978). The Board is

responsible for establishing and amending benefit provisions of the healthcare plan and is also authorized to designate

optional and/or voluntary benefits like dental, vision, supplemental life insurance, and long-term care policies.

Eligible retirees are: 1) retirees who make contributions to the fund for at least five years prior to retirement and whose

eligible employer during that period of time made contributions as a participant in the RHCA plan on the person's

behalf unless that person retires before the employer's RHCA effective date, in which the event the time period

required for employee and employer contributions shall become the period of time between the employer's effective

date and the date of retirement; 2) retirees defined by the Act who retired prior to July 1, 1990; 3) former legislators

who served at least two years; and 4) former governing authority members who served at least four years.

The RHCA issues a publicly available stand-alone financial report that includes financial statements and required

supplementary information for the postemployment healthcare plan. That report and further information can be

obtained by writing to the Retiree Health Care Authority at 4308 Carlisle NE, Suite 104, Albuquerque, NM 87107.

Funding Policy

The Retiree Health Care Act (Section 10-7C-13 NMSA 1978) authorizes the RHCA Board to establish the monthly

premium contributions that retirees are required to pay for healthcare benefits. Each participating retiree pays a

monthly premium according to a service based subsidy rate schedule for the medical plus basic life plan plus an

additional participation fee of five dollars if the eligible participant retired prior to the employer's RHCA effective date or

is a former legislator or former governing authority member. Former legislators and governing authority members are

required to pay 100% of the insurance premium to cover their claims and the administrative expenses of the plan. The

monthly premium rate schedule can be obtained from the RHCA or viewed on their website at

www.nmrhca.state.nm.us.

The Retiree Health Care Act (Section 10-7C-15 NMSA 1978) is the statutory authority that establishes the reqUired

contributions of participating employers and their employees. The statute requires each participating employer to

contribute 1.3% of each participating employee's annual salary; each participating employee is required to contribute

.65% of their salary. Employers joining the program after 1/1/98 are also required to make a surplus-amount

contribution to the RHCA based on one of two formulas at agreed-upon intervals.

The RHCA plan is financed on a pay-as-you-go basis. The employer, employee and retiree contributions are required

to be remitted to the RHCA on a monthly basis. The statutory requirements for the contributions can be changed by

the New Mexico State Legislature.

The Corrections Department contributions to the RHCA for the years ended June 30, 2009, 2008, and 2007 were

$1,n2,339, $1,702,769, and $1,489,183, respectively, which equal the required contributions for each year.

- 47-

NOTES:

FUNDS HELD IN TRUST BY OTHERS

The Department, through the Penitentiary of New Mexico (PNM), is an income beneficiary of a portion of the State

Permanent Fund derived from trust lands assigned to PNM by the Fergusson Act of 1898 and the New Mexico

Enabling Act of 1910. These Acts together transferred surface acres and mineral acres of Federal Land to the Terr~ory

of New Mexico. The grants stipulate that such lands are to be held in trust for the benefit of specifically idenmied state

instiMions.

The Department is also an income beneficiary of a portion of the State Charitable, Penal and Reformatory Institutions

Permanent Fund derived from trust lands assigned to PNM by the Fergusson Act of 1898 and the New Mexico

Enabling Act of 1910.

Responsibility for the investment of the State Permanent Fund resides w~h the State Investment Officer. Because the

Department does not control the funds, they are not reflected in the accompanying financial statements. Income from

the trust is required to be used for the care and custody of adult offenders and is recognized in the general fund as a

component of other state fund revenues.

At June 30, 2009 the value of the Department's interest in the State Permanent Fund was $159,374,552 at market.

Income from the trust for the year then ended was $10,438,513.

The value of the Department's interest in the State Charitable, Penal and Reformatory InstiMions Fund was lf7th of the

fair market value, which was $72,378,590 at June 30, 2009. Income from the trust for the year then ended was

$683,330.

NOTE 9: OPERATING LEASE COMMITMENTS

The Department is obligated for office space lease agreements for Probation and Parole Division field offICes, copier

and mailing equipment leases Department wide, and GSD Motor Transportation Pool vehicle leases Department wide,

all being accounted for as operating leases. Operating leases do not give rise to property rights or lease obligations;

therefore, the results of these lease agreements are not reflected in the Departmenfs account groups.

Future minimum annual payments under operating lease agreements for facilities, vehicles, and equipment are as

follows:

Year Ended June 30,

2010

2011

2012

2013

2014

Thereafter

Total Minimum Lease Payments

$

4,012,210

3,692,318

3,516,179

3,136,282

2,964,472

4,657,874

$

21,979,335

During the year ended June 30, 2009, general fund operating lease expend~ures for facilities, vehicles, and equipment

totaled $4,702,411.

- 48-

Beginning on OCtober 1, 2001 most of the vehicles originally purchased, owned and maintained by NMCD were

transferred to the General Services Department (GSD). The following schedule identifies the amount of expected

payments for these vehicles. These amounts are also included in the above schedule.

2010

2011

2012

2013

2014

Thereafter

Total Minimum Lease Payments

$

$

1,332,833

1,338,549

1,338,549

1,338,549

1,338,549

1,338,549

8,025,578

The Corrections Industries Division is lessor of farmland at the minimum unit of the Central New Mexico Correctional

Facility in Los Lunas, New Mexico. The following schedule identifies the amount of expected farm rent revenue for the

enterprise fund:

Year Ended June 30,

2010

Total Minimum Lease Payments

NOTE 10:

$

$

135,000

135,000

CHANGES IN LONG·TERM LIABILITIES

The changes in long-term Iiabil~ies for government type activ~ies are as follows:

Compensated Absences:

Annual Leave

Compensatory Leave

Sick Leave

Total Long-Term Liabilities

Balance

Beginning

$ 4,189,065

198,876

84,533

Increase

$ 4,082,074

381,842

231,235

(Decrease)

$ (4,219,276)

(199,731)

(227,117)

Balance

Ending"

$ 4,051,863

380,987

88,651

4,472,474

$ 4,695,151

$ (4,646,124)

$ 4,521,501

(Decrease)

(86,820)

$

Balance

Ending"

115,107

$

$

The changes in long-term liabilities for business-type activities are as follows:

Business-type

Compensated Absences:

Annual Leave

Total Long-Term Liabil~ies

Balance

Beginning

118,913

$

$

Increase

83,014

118,913

$

83,014

$

$

(86,820)

$

115,107

*The estimated amount expected to be paid for Compensated Absences within one year is $4,521,501, which is listed

on the Statement of Net Assets on page 13. The General Operating Funds typically have been used to liqUidate Iongterm liabilijies like capital leases and compensated absences. The General Operating Funds used are SHARE funds

89800, 90200, 90700, and 91500. The entire balance of $115,107 for the business-type activities is expected to be

paid for within one year.

- 49·

NOTE 11:

OTHER FINANCING SOURCES AND OPERATING TRANSFERS

Transfer In/Out:

During the fiscal year, the Department received funds that were recorded as " Other Financing Sources' in the financial

records. These amounts include State General Fund Appropriations (1) $290,382,900 which includes $2,532,000 was

appropriated to Department of Finance & Administration for distribution to the Corrections Department as part as a

compensation increase for its employees. (2) $237,780 was received from GSD Risk Management Division for costs

related to legal staff defending the Department on Pro Se cases. (3) $1,000,000 was transferred to the Department of

Finance &Administration as part of Senate Bill 79 for the purpose of meeting appropriations from the General Fund.

(4) $446,828 was received from the State Board of Finance for ongoing projects being conducted throughout the state.

(5) The department transferred to the State General Fund as part of its reversions $5,386,187. This amount includes

$1,100 that was reverted from fund 91500 during the fiscal year (additional information regarding this amount can be

found in Note 2-9 starting on page 36). The following is a breakdown of these transactions by fund:

SHARE

Agency I

Fund

State General Fund Appropriations

(1) SHARE System Fund 90200

(1) SHARE System Fund 90200

(1) SHARE System Fund 90700

(1) SHARE System Fund 90700

(1) SHARE System Fund 91500

(1) SHARE System Fund 91500

34101-85300

34100-62000

34101-85300

34100-62000

34101-85300

34100-62000

Total State General Fund Appropriations

General Fund

(2) SHARE System Fund 90700

(3) SHARE System Fund 91500

35000-35703

34101-85300

Total Operating Transfers· General Fund

State Capital Projects Fund

(4) SHARE System Fund 99700

34100-66400

Total Operating Transfers· State Capital Projects Fund

State General Fund Reversions

(5) SHARE System Fund 90700

(5) SHARE System Fund 91500

(5) SHARE System Fund 99700

34100-85300

34100-85300

34100-85300

Total State General Fund Reversions

- 50-

Transfer In

Transfer Out

3,838,900

16,800

253,543,100

2,174,000

30,468,900

341,200

$

$ 290,382,900

$

237,780

$

$

$

1,000,000

$

237,780

$

$

446,828

$

$

446,828

$

1,000,000

$

$

3,441,893

1,943,315

979

$

$

5,386,187

NOTE 12:

CONCENTRATIONS AND INTERFUND TRANSACTIONS

Substantially all Corrections Industries Division sales are to other government agencies.

In addition, the Enterprise Fund (Corrections Industries) conducts business with the Corrections Department General

Fund in the form of sales of goods and services. These sales are at list price unless a sale price or other discount is

also available to other customers. Sales to the general fund dUring fiscal year ended June 30, 2009 amounted to

$1,847,579.

Inmates at various institutions are required to work for the institutions or provide direct labor in the Corrections

Industries work programs reflected in Schedules G-1 and C-2. These inmates are compensated at nominal rates, and

their earnings are paid to the credit of the inmate trust accounts reported in the Agency Fund. During fiscal year ended

June 30, 2009 the Enterprise Fund incurred $366,815 in inmate wages expense.

The inmates make purchases from the facility canteen (commissaries), which result in Other State Funds revenues to

the General Fund. During fiscal year ended June 30, 2009 the General Fund recorded $1,271,864 in such revenues.

NOTE 13:

CONTINGENT LIABILITIES (CLAIMS &JUDGMENTS)

The Department as a State Agency defined in the New Mexico Tort Claims Act, is insured through the State of New

Mexico General Services Department, Risk Management Division. The Office of Risk Management Division pays

annual premiums for coverage provided in the following areas:

1.

2.

3.

LiabUity and civU rights protection for claims made by others against the State of New Mexico;

Coverage to protect the State of New Mexico's property and assets; and

Fringe benefit coverage for State of New Mexico employees.

In the case of civil actions or claims against the Department for financial damages, the Departmenrs certificate of

insurance with Risk Management does not cover claims for back wages but does cover civil rights claims for other

compensatory damages.

The Department is involved in several pending legal matters involving back wages. The risk of loss in most of these

cases is deemed to be 'slight to moderate' by the Department's counsel and management and the potential loss would

not materially adversely affect the financial statements.

NOTE 14:

BOND PROCEEDS

To comply with Governmental Accounting Standards Board Statement No. 33 (GASBS 33), Accounting and Financial

Reporting for Nonexchange Transactions, the Department has been authorized by the Legislature for a portion bond

proceeds. The Severance Tax Bonds were appropriated by Laws of 2007, Chapter, 42, Section 7 to plan, design,

construct, equip, and furnish a kitchen and roof project, including repairs, at Correctional Centers. Under the modified

accrual basis of accounting, GASBS 33 requires that the recognition of revenues and expenditures occur only when all

applicable eligibility requirements have been met. The Department request draw downs from the State Board of

Finance and recognizes revenue only when the eligibility requirements have been met.

- 51 •

NOTE 15:

FUND BALANCE

Unreserved. Designated for Future Expenditures:

This designation is used to restrict the use of resources from special appropriations and to restrict cash balance

amounts that have been requested for re-budget in subsequent years.

The Department did request the use $250,000 of these funds in its fiscal year 2011 request. The amount requested

was in the General Operating Fund 91500 thereby reducing the amount of the appropriation request. In addition, the

Department maintains a cash balance designation for contingency purposes. This designation is less than one ha" of

one percent (.5%) of the total operating budget.

Excess budget remaining in the Community Corrections Special revenue fund at fiscal year-end statutorily does not

revert to the State General Fund. The Department has requested to use $659,500 of this amount in its fiscal year 2011

request, thereby reducing the amount of the current year appropriation request.

The following is a breakout of the Unreserved, Designated for Future Expenditures:

Governmental Funds

General Operating Fund

State Capital Projects Fund

Community Corrections Special Revenue Fund

$ 4,910,805

308,154

1,514,284

$ 6,733,243

Reserved for Subsequent Year Expenditure

This reserve was created to represent the portion of fund balance that has been requested by the Department and

appropriated by the New Mexico State Legislature for use in the subsequent fiscal year.

The following is a breakout of the Reserved for Subsequent Year Expenditures appropriated by the New Mexico State

Legislature for use in fiscal year 2009:

Reserved for Subsequent Years Expenses

Governmental Funds

General Operating Fund

Community Corrections Special Revenue Fund

- 52·

$

180,854

545,700

$

726,554

NOTE 16:

JPA AND MOU DISCLOSURE

The Department was a party to the following Joint Power Agreements (JPA) and Memorandums of Understanding

(MOU) during fiscal year 2009:

EMNRD Forestry Work Crews - JPA between NMCD and Energy Minerals and Natural Resources Department

(EMNRD) to provide inmate forestry work camp that will provide training and labor for fire suppression. JPA will

incorporate inmates at the Central New Mexico Correctional Facility (CNMCF) and New Mexico Women's Correctional

Facility.

o

o

o

o

o

o

o

Responsible Party for Operations: EMNRD Forestry

Time period: October 14,1997 to indefinite

Total estimated amount of Project: $112,105

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: EMNRD

Revenue Reported: NMCD

EMNRD Inmate Work Crews - JPA between NMCD and EMNRD to provide inmate labor to maintain New Mexico

State Parks.

o

o

o

o

o

o

o

Responsible Party for Operations: EMNRD

Time period: July 20, 2001 to indefin~e

Total estimated amount of Project: $95,000

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: EMNRD

Revenue Reported: NMCD

NM Tort Claims Act - JPA between NMCD and General Services Department, Risk Management Division to provide

legal representation of NMCD employees pursuant to the New Mexico Tort Claims Act (Pro Se cases). Yearly

allotment made to the NMCD Office of General Counsel.

o

o

o

o

o

o

o

Responsible Party for Operations: General Services Department (GSD)

Time period: July 1, 2008 to June 30, 2012

Total estimated amount of Project: $987,384

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Aud~ Responsibility: GSD

Revenue Reported: NMCD

Inmate Education - JPA between NMCD and Eastern New Mexico University (ENMU) to provide post secondary and

vocational education for residents of New Mexico Correctional Centers.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time period: August 29, 2008 to June 30, 2009

Total estimated amount of Project: $262,100

Portion Applicable to NMCD: $262,100

Amount Agency Contributed in Fiscal Year 09: $189,136

Audit Responsibility: NMCD

Revenue Reported: ENMU

- 53-

NOTE 16:

JPA and MOU Disclosure (Continued)

Inmate Education - JPA between NMCD and Eastern New Mexico University (ENMU) to provide post secondary

education for inmates and library services for the residents of New Mexico Correctional Centers in Las Cruces, Los

Lunas, Santa Fe, Grants, and Hagerman, New Mexico.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time period: August 29, 2008 to June 30, 2009

Total estimated amount of Project: $16,500

Portion Applicable to NMCD: $16,500

Amount Agency Contributed in Fiscal Year 09: $14,157

Audit Responsibility: NMCD

Revenue Reported: ENMU

Inmate Instructional Training - JPA between NMCD and Eastern New Mexico University (ENMU) to provide post

secondary and vocational education for youth offenders at NMCD facilities who are twenty five years of age and under

and who have less than five years to serve on their sentence.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time period: August 29, 2008 to June 30, 2009

Total estimated amount of Project: $113,369

Portion Applicable to NMCD: $113,369

Amount Agency Contributed in Fiscal Year 09: $102,819

Audij Responsibility: NMCD

Revenue Reported: ENMU

Landfill I Transfer Station Work Crews - JPA between NMCD and the South Central Solid Waste Authority (SCSWA)

to provide inmate work crews for maintenance, beautffication, and enhancement at the Corralitos landfill or transfer

station in Dona Ana County.

o

o

o

o

o

o

o

Responsible Party for Operations: South Central Solid Waste Authority

Time period: May 5, 2005 to Indefinite

Total estimated amount of Project: Income

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: SCSWA

Revenue Reported: NMCD

Clinical Services - JPA between NMCD and the New Mexico Department of Heanh (NMDOH) to provide HIVIAIDS

clinical services for inmates with the HIV disease.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time period: July 1, 2007 to June 30, 2011

Total estimated amount of Project: $350,000

Portion Applicable to NMCD: $350,000

Amount Agency Contributed in Fiscal Year 09: $469,201

Audij Responsibility: NMCD

Revenue Reported: NMDOH

- 54-

NOTE 16:

JPA and MOU Disclosure (Continued)

Trans~ional

Reporting Services - JPA between the New Mexico Department of Health (NMDOH) and the NMCD to

provide FTE to support the Trans~ional Reporting Center Programs in the Albuquerque and Las Cruces areas.

o

o

o

o

o

o

o

Responsible Party for Operations: NMDOH

Time period: Indefin~e

Total estimated amount of Project: $1,000,000

Portion Applicable to NMCD: -DAmount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: NMDOH

Revenue Reported: NMCD

Inmate Labor - JPA between NMCD and the Department of Veteran's Affairs (DVA) to provide inmate labor for

maintenance, litter control, and beautification of the Santa Fe National Cemetery (SFNC). Officer and inmate wages

are reimbursed by DVA.

o

o

o

o

o

o

o

Responsible Party for Operations: DVA

Time period: August 26. 2003 to indefinite

Total estimated amount of Project: $51,840

Portion Applicable to NMCD: -DAmount Agency Contributed in Fiscal Year 09: -DAud~ Responsibility: DVA

Revenue Reported: NMCD

EMNRD Forestrv Work Crews - JPA between NMCD and NM Energy Minerals and Natural Resources Department

(EMNRD) and Corrections Corporation of America (CCA) to provide inmate forestry work camps that will provide

training and labor for fire suppression.

o

o

o

o

o

o

o

Responsible Party for Operations: EMNRD

Time period: October 14, 1997 to Indefinite

Total estimated amount of Project: $150,000

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: EMNRD

Revenue Reported: NMCD

Inmate Labor - JPA between NMCD and the New Mexico Department of Transportation (NMDOT) to provide inmate

labor for highway maintenance and beautification. Officer and inmate wages are reimbursed by NMDOT.

o

o

o

o

o

o

o

Responsible Party for Operations: NMDOT

Time period: June 25, 2007 to June 30, 2011

Total estimated amount of Project: Income

Portion Applicable to NMCD: -DAmount Agency Contributed in Fiscal Year 09: -0Aud~ Responsibility: NMDOT

Revenue Reported: NMCD

- 55-

NOTE 16:

JPA and MOU Disclosure (Continued)

Inmate Education - JPA between NMCD and Mesalands Community College to provide post secondary and vocational

education to inmates housed in Santa Rosa and Clayton, New Mexico.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time period: September 8, 2008 to June 30, 2009

Total estimated amount of Project: $70,000

Portion Applicable to NMCD: $70,000

Amount Agency Contributed in Fiscal Year 09: $69,992

Aud~ Responsibility: NMCD

Revenue Reported: Mesalands Commun~ College

Inmate Labor - JPA between NMCD and the Santa Fe Solid Waste Management Agency (SFSWM) to provide inmate

labor to perform minor maintenance, beautification, and litter control of the Caja Del Rio Landfill property and other

properties as directed by the agency.

o

o

o

o

o

o

o

Responsible Party for Operations: SFSWM

Time period: September 1, 2001 to Indefin~e

Total estimated amount of Project: $40,000

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: SFSWM

Revenue Reported: NMCD

Inmate Labor - JPA between NMCD and the C~ of Grants to provide inmate work crews for maintenance,

beautification, and enhancement at various locations in the City of Grants, New Mexico.

o

o

o

o

o

o

o

Responsible Party for Operations: C~ of Grants

Time Period: December 5, 2008 to Indefin~e

Total Estimated amount of Project: Income

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibil~: City of Grants

Revenue Reported: NMCD

Inmate Labor - JPA between NMCD and the C~ of Santa Fe to provide inmate labor to perform minor maintenance,

beautification, and litter control in the Santa Fe public areas and other properties as directed by the agency.

o

o

o

o

o

o

o

Responsible Party for Operations: City of Santa Fe

Time Period: November 18, 1999 to Indefinite

Total Estimated amount of Project: $101,000

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Aud~ Responsibil~: City of Santa Fe

Revenue Reported: NMCD

- 56-

NOTE 16:

JPA and MOU Disclosure (Continued)

Inmate Labor - JPA between NMCD and the City of Las Cruces to provide inmate labor to perform minor maintenance,

beaut~ication, and litter control in the Las Cruces public areas and other properties as directed by the agency.

o

o

o

o

o

o

o

Responsible Party for Operations: City of Las Cruces

Time Period: July 28, 1998 to Indefinite

Total Estimated amount of Project: Income

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: City of Las Cruces

Revenue Reported: NMCD

Reimbursement of Travel Exoenses - MOU between NMCD and Children Youth and Families Department (CYFD) for

the reimbursement of travel expenses pertaining to an out-of-state inmate transport.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time Period: May 30,2009 - June 1, 2009

Total Estimated Amount of Project: Income

Portion Applicable to NMCD: $690

Amount Agency Contributed in Fiscal Year 09: $690

Audit Responsibility: CYFD

Revenue Reported: NMCD

Representation for Writs of Habeas Corpus- MOU between NMCD and the Attomey General's Office (AG) to provide

for representation by the Office of the Attomey General to those persons named as respondents in petitions for Writs of

Habeas Corpus in federal court.

o

o

o

o

o

o

o

Responsible Party for Operations: NM Attorney General

Time period: July 1, 2009 - Indefinite

Total estimated amount of Project: $25,000 +

Portion Applicable to NMCD: $25,000 +

Amount Agency Contributed in Fiscal Year 09: $13,349

Audit Responsibility: NM Attorney General

Revenue Reported: NM Attorney General

Inmate Tracking - MOU between NMCD and the New Mexico Human Services Department for the tracking of all

inmates and parolees named in Child Support Enforcement Cases.

o

o

o

o

a

o

o

Responsible Party for Operations: HSD I NMCD

Time Period: June 4, 2003 - Indefinite

Total Estimated Amount of Project: -0Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: HSD I NMCD

Revenue Reported: Agreement only, no funds transferred

- 57-

NOTE 16:

JPA and MOU Disclosure (Continued)

Educational Travel Reimbursement - MOU between NMCD and the Northeast New Mexico Detention Facility

(NENDF) to reimburse NENMDF for travel costs associated with NMCD educationaVtraining classes.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD / NENMDF

Time Period: October 1, 2008 - October 1, 2010

Total Estimated Amount of Project: Undetermined

Portion Applicable to NMCD: Agreed Upon Costs

Amount Agency Contributed in Fiscal Year 09: -0Audit Responsibility: NMCD / NENMDF

Revenue Reported: NENMDF

Educational Travel Reimbursement - MOU between NMCD and the Guadalupe County Correctional Facility to

reimburse GCCF for travel costs associated with NMCD educationaVtraining classes.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD / GCCF

Time Period: October 1, 2008 - October 1, 2010

Total Estimated Amount of Project: Undetermined

Portion Applicable to NMCD: Agreed Upon Costs

Amount Agency Contributed in Fiscal Year 09: $3,149

Audit Responsibility: NMCD / GCCF

Revenue Reported: GCCF

Training of Personnel from Central America - MOU between NMCD and Department of State, Bureau for International

Narcotics and law Enforcement Affairs (INL) for training and mentoring of corrections personnel from Central America.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD / INL

Time Period: April 7, 2009 - March 31, 2010

Total Estimated Amount of Project: Undetermined

Portion Applicable to NMCD: $14,754

Amount Agency Contributed in Fiscal Year 09: $14,754

Audit Responsibility: NMCD / INL

Revenue Reported NMCD

Collective Bargaining Negotiations - MOU between NMCD, Multiple Agencies and Department of Finance &

Administration (DFA) for the representation during collective bargaining negotiations.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time Period: May 4, 2005 • Indefinite

Total Estimated Amount of Project: $16,310

Portion Applicable to NMCD: $16,310

Amount Agency Contributed in Fiscal Year 09: $16,310

Audit Responsibility: NMCD

Revenue Reported: DFA

- 58-

NOTE 16:

JPA and MOU Disclosure (Continued)

Inmate Labor - MOU between NMCD and New Mexico Department of Military Affairs (NMDMA) for inmate labor to

perform janitorial and maintenance services.

o

o

o

o

o

o

o

Responsible Party for Operations: NMDMA

Time Period: April 25, 2005 - Indefinite

Total Estimated Amount of Project: Income

Portion Applicable to NMCD: -0Amount Agency Contributed in Fiscal Year 09:-0Audit Responsibility: NMDMA

Revenue Reported: NMCD

Hepatitis C Medication and Pharmaceutical Consu~ing - MOU between NMCD and New Mexico Department of

Health (NMDOH) to provide Hepatitis Cmedication and consu~ing to NMCD inmates with the HCV Disease.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD

Time Period: April 25, 2005 - Indefinite

Total Estimated Amount of Project: Reimbursement of actual Costs

Portion Applicable to NMCD: Reimbursement of actual Costs

Amount Agency Contributed in Fiscal Year 09: $154,033

Audit Responsibility: NMCD

Revenue Reported: NMDOH

International and Domestic Terrorism Taskforce - MOU between NMCD and the Federal Bureau of Investigations

(FBI) to form the New Mexico Joint Terrorism Taskforce.

o

o

o

o

o

o

o

Responsible Party for Operations: NMCD / FBI

Time Period: April 25, 2005 - Indefinite

Total Estimated Amount of Project: Income

Portion Applicable to NMCD: $6,141

Amount Agency Contributed in Fiscal Year 09: $6,141

Audit Responsibility: FBI

Revenue Reported: NMCD

- 59-

GENERAL FUND

The General Fund is used to account for resources traditionally associated with government, which

are not required legally or by sound financial management to be accounted for in another fund.

The General Fund is comprised of the New Mexico Corrections Department Performance Based

Budgeting Programs, and the traditional budgets for the ASD Building Fund, the Special

Appropriation for the Computer System Enhancement, various other Special Appropriation Z

Codes, and the State Capital Projects Fund as listed below. The General Fund is accounted for at

the Department of Finance and Administration within the Statewide Human Resources,

Accounting, and Management Reporting System (SHARE) Fund 90700 unless otherwise noted.

Program Support (Fund 90700)

Administrative Services Division (ASD)

Inmate Management and Control (Fund 90700)

Health Services Bureau (HSB)

Adult Prisons Division (APD)

Corrections Training Academy (CTA)

Western New Mexico Correctional Facility (WNMCF)

Southern New Mexico Correctional Facility (SNMCF)

Penitentiary of New Mexico (PNM)

Central New Mexico Correctional Facility (CNMCF)

Roswell Correctional Center (RCC)

Springer Correctional Center (SCC)

Inmate Programming (Fund 90700)

Education Bureau (EDB)

Addiction Services Bureau (ASB)

Community Offender Management (Fund 91500)

Probation & Parole Division (PPD)

Community Corrections I Vendor Operated (Fund 90200)

Community Corrections (CC)

Traditional Budget

ASD Building Fund (Fund 89800)

State Capital Projects Fund (99700)

Computer System Enhancement (Fund 90700)

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

PROGRAM SUPPORT

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

8,581,400

79,500

232,000

$

8,892,900

8,687,200

129,230

237,780

Actual Amounts

Budgetary Basis

$

9,054,210

8,687,200

132,529

237,780

Variance Favorable

(Unfavorable)

$

3,299

3,299

9,057,509

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

8,892,900

$

9,054,210

$

9,057,509

$

3,299

$

6,937,800

404,700

1,550,400

$

6,966,180

397,000

1,691,030

$

6,931,635

389,128

1,613,392

$

34,545

7,872

n,638

124,107

Total Budgeted Expenditures

$

8,892,900

$

9,054,210

$

9,058,262

The accompanying notes are an integral part of the financial statements

- 60-

(124,107)

$

(4,052)

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

INMATE MANAGEMENT and CONTROL

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

242,860,800

13,918,200

25,000

$

236,951,600

13,423,241

Actual Amounts

Budgetary Basis

$

19,937

250,394,778

256,804,000

236,951,600

14,710,840

Variance Favorable

(Unfavorable)

$

1,287,599

19,937

251,682,377

1,287,599

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

256,804,000

$

250,394,778

$

251,682,377

$

1,287,599

$

97,823,900

52,418,900

106,561,200

$

99,578,159

48,783,800

102,032,819

$

99,057,532

48,345,m

99,643,084

$

520,627

438,023

2,389,735

2,815,920

Total Budgeted Expenditures

$

256,804,000

$

250,394,778

$

249,862,313

The accompanying notes are an integral part of the financial statements

- 61 -

(2,815,920)

$

532,465

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES &EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

INMATE PROGRAMMING

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

10,198,100

5,500

$

301,200

10,504,800

10,003,300

5,980

Actual Amounts

Budgetary Basis

$

372,286

10,381,566

10,003,300

20,646

Variance Favorable

(Unfavorable)

$

14,666

343,176

10,367,122

(29,110)

(14,444)

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services.

Other

Operating Transfers

Reversions

Total Budgeted Expenditures

$

10,504,800

$

10,381,566

$

10,367,122

$

(14,444)

$

8,453,400

864,100

1,187,300

$

8,776,256

473,969

1,131,341

$

8,673,298

451,452

753,707

$

102,958

22,517

377,634

486,999

$

10,504,800

$

10,381,566

$

10,365,456

The accompanying notes are an integral part of the financial statements

- 62-

(486,999)

$

16,110

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

COMMUNITY OFFENDER MANAGEMENT

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

31,515,900

1,528,000

$

EXPENDITURES

Personal Services &

Employee Benefns

Contractual Services

Other

Operating Transfers

Reversions

Total Budgeted Expend~ures

$

62,905

32,555,005

33,043,900

Rebudgeted Cash

Total Budgeted Revenues

30,795,100

1,697,000

Actual Amounts

Budgetary Basis

30,795,100

2,690,534

Variance Favorable

(Unfavorable)

$

993,534

23,358

33,508,992

(39,547)

953,987

1,000,000

(1,000,000)

$

33,043,900

$

33,555,005

$

33,508,992

$

(46,013)

$

20,570,900

38,700

12,434,300

$

20,265,830

38,000

12,251,175

1,000,000

$

20,057,084

30,088

10,775,475

1,000,000

1,928,315

$

208,746

7,912

1,475,700

33,790,962

$

$

33,043,900

$

* $1 ,000,000 was re-budgeted from

33,555,005

$

cash balance.

The accompanying notes are an integral part of the financial statements

- 63-

(1,928,315)

(235,957)

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

COMMUNITY CORRECTIONS I VENDOR OPERATED

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Total Budgeted Expenditures

3,930,500

51,700

$

3,855,700

51,700

3,982,200

3,907,400

545,700

545,700

Actual Amounts

Budgetary Basis

$

3,855,700

143,395

Variance Favorable

(Unfavorable)

$

91,695

3,999,095

91,695

(545,700)

$

4,527,900

$

4,453,100

$

3,999,095

$

(454,005)

$

847,500

56,800

3,623,600

$

846,300

62,560

3,544,240

$

813,200

41,945

3,259,371

$

33,100

20,615

284,869

$

4,527,900

$

4,453,100

$

4,114,516

$

338,584

• $545,700 was re-budgeted from cash balance.

The accompanying notes are an integral part of the financial statements

- 64-

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

COMPUTER SYSTEMS ENHANCEMENT

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

995,044

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Beneftts

Contractual Services

Other

Operating Transfers

Reversions

Total Budgeted Expenditures

$

995,044

$

$

995,044

$

995,044

$

$

995,044

922,175

72,869

$

-

$

Variance Favorable

(Unfavorable)

Actual Amounts

Budgetary Basis

(995,044)

$

$

922,175

72,869

$

995,044

$

-

$

120,078

15,609

$

*$995,044 was re-budgeted from cash balance.

The accompanying notes are an integral part of the financial statements

- 65-

-

135,687

(995,044)

802,097

57,260

$

859,357

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES &EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Bud Reference 10824 - FUND 90700

Life-to-Date

Budgeted

Amounts

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

FY09Actuai

Amounts

Budgetary Basis

L1fe-to-Date

Actual Amounts

Budgetary Basis

Variance

Favorable

(Unfavorable) *

$

$

$

896,075

896,075

448,067

448,067

(97,415)

(97,415)

798,660

798,660

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

Total Budgeted Expenditures

$

896,075

$

$

$

310,645

585,430

$

448,067

896,075

$

448,067

$

(97,415)

$

$

167,036

281,031

$

798,660

240,971

557,689

$

798,660

69,674

27,741

$

* Budget for the various projects under this budget reference was established in a previous fiscal year and will

cover multiple fiscal periods that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

- 66-

97,415

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Z 80185 - FUND 90700

Life-to-Date

Budgeted

Amounts

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

405,000

FY09Actual

Amounts

BUdgetary Basis

$

Variance

Favorable

(Unfavorable)

Life-to-Date

Actual Amounts

Budgetary Basis

$

405,000

405,000

$

405,000

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

405,000

$

$

$

$

$

405,000

Total Budgeted Expenditures

$

405,000

$

405,000

$

$

390,261

390,261

14,739.00

14,739

14,739

(14,739.00)

405,000

$

405,000

$

* Budget for the various projects under this fund were established in a previous fiscal year and will cover

multiple fiscal periods that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

- 67-

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES &EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Z80187 - FUND 90700

Life-to-Date

Budgeted

Amounts

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

150,000

FY09Actuai

Amounts

Budgetary Basis

$

Llfe-to-Date

Actual Amounts

Budgetary Basis

$

150,000

150,000

Variance

Favorable

(Unfavorable)

$

150,000

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

150,000

$

$

$

$

$

150,000

Total BUdgeted Expendnures

$

150,000

150,000

$

150,000

150,000

$

$

150,000

$

150,000

$

* Budget for the various projects under this fund were established in a previous fiscal year and will cover

multiple fiscal periods that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

- 68-

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Z 80188 - FUND 90700

Llfe-to-Oate

Budgeted

Amounts

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

445,000

FY09Actual

Amounts

Budgetary Basis

Llfe-to-Date

Actual Amounts

Budgetary Basis

$

$

445,000

445,000

Variance

Favorable

(Unfavorable)

$

445,000

Rebudgeted Cash

Total BUdgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

445,000

$

$

$

$

$

445,000

445,000

Total Budgeted Expend~ures

$

445,000

$

445,000

445,000

$

$

445,000

$

445,000

$

* Budget for the various projects under this fund were established in a previous fiscal year and will cover

multiple fiscal periods that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

- 69-

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES &EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Z 80189 - FUND 90700

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

234,733

$

234,733

$

$

$

$

234,733

$

234,733

Variance Favorable

(Unfavorable)

$

234,733

62,973

171,760

Total Budgeted Expenditures

Actual Amounts

Budgetary Basis

(234,733)

$

$

$

$

32,341

202,392

$

234,733

$

32,314

202,291

27

101

128

(128)

234,733

*$234,733 was re-budgeted from cash balance.

The accompanying notes are an integral part of the financial statements

-70 -

(234,733)

$

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Z 90153 - FUND 90700

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

75,000

$

75,000

75,000

Actual Amounts

Budgetary Basis

$

75,000

75,000

Variance Favorable

(Unfavorable)

$

75,000

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

75,000

$

$

$

75,000

Total Budgeted Expend~ures

$

75,000

75,000

$

$

75,000

$

$

75,000

$

75,000

75,000

$

$

• Budget for the various projects under this fund were established in a previous fiscal year and will cover

multiple fiscal periods that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

- 71 -

75,000

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES &EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Z 80185 - FUND 91500

FY 09 Actual

Llfe-to-Date

Amounts Budetary

Budgeted Amounts

Basis

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

95,000

$

Life-to-Date Actual

Amounts Budgetary

Basis

$

95,000

95,000

Variance Favorable

(Unfavorable)

$

95,000

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

95,000

$

$

$

$

$

95,000

Total Budgeted Expend~ures

$

95,000

95,000

$

95,000

95,000

$

$

95,000

$

95,000

$

* Budget for the various projects under this fund were established in a previous fiscal year and will cover

mUltiple fiscal periods that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

-72 -

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES &EXPENDITURES - BUDGET AND ACTUAL

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Z 81291 - FUND 91500

Budgeted Amounts

Original

Final

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

15,000

$

15,000

Actual Amounts

Budgetary Basis

13,900

$

13,900

15,000

Variance Favorable

(Unfavorable)

$

15,000

1,100

1,100

Rebudgeted Cash

Total BUdgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$

15,000

$

$

13,900

$

15,000

$

15,000

$

$

$

13,900

13,900

15,000

Total Budgeted Expenditures

$

15,000

$

13,900

$

The accompanying notes are an integral part of the financial statements

- 73-

1,100

15,000

(15,000)

$

(1,100)

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL BY FUND

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

BUILDING FUND

SHARE FUND 89800

Budgeted Final

Amounts

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Total Budgeted expenditures

Actual Amounts

Budgetary Basis

Variance

Favorable

(Unfavorable)

$

$

273,000

$

273,000

$

(273,000)

$

$

$

$

273,000

$

273,000

273,000

$

*$273,000 was re-budgeted from cash balance.

The accompanying notes are an integral part of the financial statements

-74 -

(273,000)

$

273,000

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL BY FUND

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

GENERAL OPERATING FUND

SHARE FUND 90700

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

Budgeted Final

Amounts

Actual Amounts

Budgetary Basis

$ 256,717,100

13,558,451

237,780

1,288,298

271,801,629

$ 256,717,100

14,864,015

237,780

1,161,773

272,980,668

Rebudgeted Cash

Variance

Favorable

(Unfavorable)

$

1,305,564

(126,525)

1,179,039

(1,229,777)

1,229,m

Total Budgeted Revenues

$ 273,031,406

$ 272,980,668

$

(50,738)

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

$ 115,320,595

50,919,930

106,790,881

$ 114,662,465

49,579,720

103,771,033

$

658,130

1,340,210

3,019,848

Total Budgeted Expenditures

$ 273,031,406

3,441,893

(3,441,893)

$ 271 ,455,111

$ 1,576,295

* $1,229,777 was re-budgeted from cash balance. The above amounts include budgets for the various

projects where the budget was established in a previous fiscal year and will cover multiple fiscal periods that

do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

- 75 -

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL BY FUND

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

PROBATION AND PAROLE GENERAL OPERATING FUND

SHARE FUND 91500

Budgeted Final

Amounts

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

EXPENDITURES

Personal Services &

Employee Benefits

Contractual Services

Other

Operating Transfers

Reversions

Total Budgeted Expenditures

$

62,905

32,663,905

Rebudgeted Cash

Total Budgeted Revenues

30,904,000

1,697,000

Actual Amounts

Budgetary Basis

30,905,100

2,690,534

Variance

Favorable

(Unfavorable)

$

1,100

993,534

(39,547)

955,087

23,358

33,618,992

(1,000,000)

1,000,000

$

33,663,905

$

33,618,992

$

(44,913)

$

20,265,830

38,000

12,360,075

1,000,000

$

20,057,084

30,088

10,870,475

1,000,000

1,943,315

$

208,746

7,912

1,489,600

33,900,962

$

$

33,663,905

$

(1,943,315)

(237,057)

* $1,000,000 was re-budgeted from cash balance. The above amounts include budgets for the various

projects where the budget was established in a previous fiscal year and will cover multiple fiscal periods

that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

-76 -

NEW MEXICO CORRECTIONS DEPARTMENT

STATEMENT OF REVENUES & EXPENDITURES - BUDGET AND ACTUAL BY FUND

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

GENERAL FUND STATE CAPITAL PROJECTS FUND

SHARE FUND 99700

Llfe-to-Date

Budgeted

Amounts

REVENUES

State General Fund

Other State Funds

Inter-Agency Transfers

Federal Funds

Total Revenues

$

Rebudgeted Cash

Total Budgeted Revenues

EXPENDITURES

Personal Services &

Employee Benef~s

Contractual Services

Other

Operating Transfers

Reversions

Total Budgeted Expenditures

25,000

FY 09 Actual

Amounts

Budgetary Basis

L1fe-to-Date

Actual Amounts

Budgetary Basis

Variance

Favorable

(Unfavorable)

$

$

2,125,000

$ 2,100,000

1,000,000

446,828

446,828

(553,172)

1,025,000

446,828

2,571,828

1,546,828

1,892,435

$

2,917,435

$

$ (1,892,435)

$

$

75,000

2,842,435

$

446,828

2,917,435

$

$

2,571,828

$

$

$

46,164

610,354

46,164

2,108,966

28,836

733,469

979

979

(979)

657,497

$

2,156,109

$

* Budget for the various projects under this fund were established during the fiscal year and will cover mUltiple

fiscal periods that do not lapse at year-end.

The accompanying notes are an integral part of the financial statements

-77 -

(345,607)

761,326

NEW MEXICO CORRECTIONS DEPARTMENT

COMBINING BALANCE SHEET GENERAL FUND TYPES - GAAP BASIS

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Building Fund

SHARE System

Fund

89800

ASSETS

Investments

Receivables net

of allowance for doubtful accounts

Federal Grants Receivable

Other Receivables

Due from Other State Agencies

Inventories

Prepaid Items

$

Total Assets

$

272,385

General Operating

Fund

SHARE System

Fund

90700

$

29,900,829

Probation &

Parole Fund

SHARE System

Fund

91500

$

21,156

297,763

8,949

1,025,266

5,008,346

257,458

272,385

5,163,416

Total *

$

35,336,630

21,156

297,763

8,949

1,025,266

5,476,780

302,835

468,434

45,377

$

36,519,767

$

5,677,227

$

42,469,379

$

17,004,743

2,199,059

345,702

2,629,576

456,091

3,441,893

2,586

259

2,077,994

$

668,886

79,987

309,345

417,893

19,760

1,942,215

41

$

17,673,629

2,279,046

655,047

3,047,469

475,851

5,384,108

2,627

259

2,077,994

L1ABIUTIES AND FUND EQUITY

liabil~ies

Vouchers Payable

Payroll Beneffls Payable

Payroll Taxes Payable

Accrued Wages Payable

Due to Other Funds

Due to State General Fund

Stale Dated Warrants - Due to SGF

Due to Other State Agencies

Deferred Revenue

Other liabilities

Totalliabilities

$

Fund Equity

Reserved for:

Inventories

SUbsequent Years Expenditures

Prepaid Expenses

Petty Cash

Unreserved / Undesignated

Designated for Future Expend~ures

Total Fund Equ~

Totalliabil~ies

and Fund Equ~

272,385

272,385

$

272,385

* Inter·fund balances have been eliminated

$

28,157,903

3,438,127

31,596,030

5,008,346

180,854

257,458

2,075

468,434

5,476,780

180,854

302,835

2,075

2,913,131

8,361,864

1,725,289

2,239,100

36,519,767

45,377

$

in the total column.

The accompanying notes are an integral part of the financial statements

-78 -

5,677,227

4,910,805

10,873,349

$

42,469,379

NEW MEXICO CORRECTIONS DEPARTMENT

COMBINING STATEMENT OF REVENUES, EXPENDITURES AND CHANGES IN FUND BALANCES - GAAP BASIS

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Revenues

Other State Funds

Federal Grants

Total Revenues

Building Fund

General

Operating Fund

Probation &

Parole Fund

SHARE System

Fund

SHARE System

Fund

SHARE System

Fund

89800

90700

91500

$

$

Expenditures, Current

Personal Services &

Employee Benefits

Contractual Services

Other

Expenditures, Capital Outlay

Total Expenditures

Excess (deficiency) Revenues over Expenditures

Other Financing Sources (uses)

General Fund Appropriation

Operating Transfers-In

Operating Transfers-Out

Reversions to State General Fund

Net Other Financing Sources (uses)

Excess Revenues and Other Financing Sources

over (under) Expenditures &Other Financing Uses

272,386

Fund Balance, Beginning of Year

Fund Balance, End of Year

$

272,386

$

14,864,015

811,180

15,675,195

2,690,534

23,358

2,713,892

$

17,554,549

834,538

18,389,087

114,662,465

49,505,785

97,789.889

5,704,486

267,662,625

20,057.084

30,088

10,518,677

351.798

30,957,647

134,719,549

49,535,873

108,308.566

6,056,284

298,620,272

(251,987,430)

(28,243,755)

(280,231,185)

255,717,100

237,780

30,810,100

(3,441,893)

252,512,987

(1,000,000)

(1,943,315)

27,866,785

286,527,200

237,780

(1,000,000)

(5,385,208)

280,379,772

525,557

(376,970)

148,587

7,836,303

2,616,073

10,724,762

8,361,860

" Inter·fund balances have been eliminated in the total column.

The accompanying notes are an integral part of the financial statements

-79 -

$

Total"

$

2,239,103

$

10,873,349

ENTERPRISE FUND

The Enterprise Fund is used to account for operations that are financed and operated in a manner

similar to private business enterprises. The Enterprise Fund is accounted for at the Department of

Finance and Administration within the Statewide Human Resources, Accounting, and Management

Reporting System (SHARE) Fund 07700.

An allocation of balance sheet items by activity is not meaningful; therefore, only a combined

balance sheet is presented in the Statement of Net Assets at both government-wide and

proprietary levels of detail. Listed below is a description of the types of activities operated by the

Department's Corrections Industries Division (CID), as shown in the following Schedule of

Revenue and Expenses, by Enterprise.

Furniture - CNMCF (Los Lunas) and SNMCF (Las Cruces) manufacture furniture for sale primarily

to government entities.

Agriculture - Lease farm operations for the production of alfalfa, hay, and other crops utilizing

private sector resources to employ inmates at the minimum unit of CNMCF. SCC farm program is

a new program that utilizing inmates to raise cattle to maturity.

Data Entry Programs - The PNM Data Entry Program employs inmates to enter computer data

for other state agencies, which are billed for the services rendered.

Printing - The GCCF print shop, located in Santa Rosa, NM, provides printing services to

government entities.

Reproduction - The Corrections Corporation of America women's facility in Grants, NM provides

microfilming and electronic imaging of documents to government entities.

Telemarketing - Telemarketing programs at the Corrections Corporation of America women's

facility, located in Grants, NM, answer telephone inquiries about tourist attractions for the New

Mexico Tourism Department and mail brochures to prospective tourists.

Shoes and Textiles (Textiles) - Clothing, shoes, mattresses, bed linens, towels and other related

products are manufactured at the privately operated men's facility in Hobbs for sale to government

entities and companies operating private prisons.

Cleaning Products - Manufacturing and production of various types of plastic cleaning products

located at WNMCF in Grants, NM.

Administrative Overhead - The costs of Sales and Marketing, the Distribution Center, Central

Office, CNMCF Administration and SNMCF Administration "enterprises" are allocated to the true

enterprises at fiscal year end.

NEW MEXICO CORRECTIONS DEPARTMENT

SCHEDULE OF REVENUES AND EXPENSES, BY ENTERPRISE

FOR THE FISCAL YEAR ENDING JUNE 30, 2009

Telemarketing

Furniture>

$ 1,282,806

Revenue from Sales

$

Cleaning

Products>

187,953

$ 518,715

CCAMicro

$

Textiles>

PNM Data

Entry

GCCF

Print

$ 1,309,410

$ 105,()()()

$173,388

Manufacturing Costs:

Costs of Materials Used:

Beginning Inventory - Materials

Materials Purchases

Net Material Transfers

Materials Available

Less Ending Inventory

Cost of Materials Used

231,429

527,611

52

759,092

(291,948)

467,144

10,242

232

61,204

288,532

3,811

589

10,474

(3,337)

7,137

349,736

(41,108)

308,628

4,400

(886)

3,514

476,378

428,865

(160)

905,083

(366,269)

538,814

Direct Labor - Inmate Pay

125,947

19,547

9,652

1,678

129,521

16,364

16,724

223,050

128,015

5,554

10,744

20,192

93,438

41,970

387

172

252

33,200

17,920

5,278

3,405

1,625

35,432

15,559

370

1,912

3,948

96,871

46,947

1,038

2,354

40,904

8,266

12,616

675

2,339

12,384

122

35,965

21,265

204

21,851

7,552

2,890

15,004

31,359

81,601

160

113,120

(37,546)

75,574

Manufacturing Overhead:

salaries

Benefits

In-State Travel

Maintenance & Repairs

Supplies

Contractual Services

Other Costs

Out-of-State Travel

Irrigation Fees

Depreciation

Miscellaneous

Total Manufacturing Overhead

4,999

228

20,194

729

5,089

931

11,744

400,820

149,063

73,901

17,324

205,587

52,651

116,475

Total Manufacturing Costs

Add Beginning Work in Process

Less Ending Work in Process

Total Cost of Goods Manufactured

Add Beginning Finished Goods

Less Ending Finished Goods

Net Finished goods Transfers

Total Cost of Goods Sold

993,911

220,384

(150,631)

1,063,664

176,153

(411,544)

(3,404)

824,869

175,747

392,181

22,516

873,922

69,015

208,773

175,747

22,516

(489)

22,027

873,922

699,823

(446,113)

(1,243)

1,126,389

69,015

654

176,401

392,181

45,286

(35,711)

4,386

406,142

765

69,780

208,773

3,941

(5,775)

(16,040)

190,899

457,937

11,552

112,573

(22,027)

183,021

35,220

(17,511)

(147,548)

(96,956)

43,906

84,038

13,042

(39,205)

17,753